4 Precious Metals Investing Myths

The following article is created and or curated by the Orion Metal Exchange for the benefit of our followers. We seek to provide relevant precious metals, economic and geopolitical content that can impact your retirement and savings. If you are interested in learning about precious metals investing, call 1-800-559-0088, for a FREE investor kit.

In the unpredictable economy of today’s world, many investors consider precious metals such as gold and silver to be a much better alternative to traditional investments such as stocks, bonds, and real estate.

More than that, precious metals, especially gold, have an exotic and intriguing value to them. Having spurred to the fancy of ancient rulers and adventurous explorers across history, gold is naturally considered a precious investment to have.

But before you invest and start reaping the significant profits, know that the metal market is littered with myths and half-truths that have no accuracy to them.

Here’s a list of all the myths that investors should not believe in:

Myth 1: Small Investors Can’t Enter the Precious Metals Market

Many people are of the belief that investors who can’t afford to put down a substantial initial investment price won’t be able to get into the precious metal market. However, the opposite is true as gold and silver investment is especially suitable for small investors. While there are markups on fractionally-sized bullions and coins; anyone who’s willing to purchase an ounce or more of gold and silver can pay a small markup over spot pricing.

Myth 2: No One Can Make a Profit off Precious Metals Since the Governments and Banks Control Its Price

Some people are of the view that the government or banks have the ability to manipulate global and spot metal prices, but this has no correlation to the profit or loss a small investor gets in the precious metals market. Bullion markets, such as gold, are mostly determined by the demand and supply of the metal. So, for example, if more buyers want gold, its value will hike up.

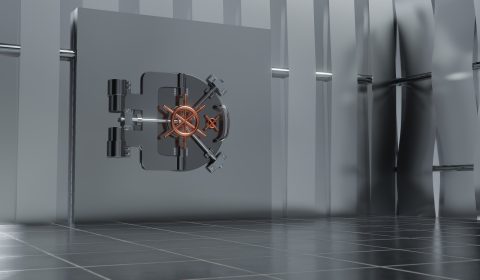

Myth 3: Precious Metal Owners Have a Problem Storing Them Securely

Investors who take physical possession of their precious metals worry about the fact that there’s no safe way to store them. With the high-tech burglars of today using advanced metal detectors to locate precious metals stored in a house, investors may give up the idea of investing altogether. However, a much safer storage solution is storing your precious metals in a secure vault.

Myth4: It Is Better to Purchase Investment-Grade Coins Rather than Raw Bullion Bars

This is another common persistent myth that is wildly untrue. Unless you have fair knowledge and a history of collecting coins, buying bullions is the safest option for novice investors.

Purchasing rare coins come with a high markup which makes them similar to investing in priceless items such as fine art, rather than precious metals. While coins are a good investment option for those who have some know-how, bullions and bars are a more practical option for those new to precious metals investment.

Looking to buy gold bullion bars or silver coins online? We at Orion Metal Exchange are your go-to precious metals investment dealer! Contact us for more details about our services.