Silver is Outperforming Gold and is Poised for a Big Breakout

Silver’s Price Potential is under the Radar

Gold has been grabbing headlines throughout much of the year for its record-breaking price performance. According to JP Morgan Private Bank, this is “The Golden Era for Gold.” Citi claims, “Gold is shining bright like a diamond.” And Bank of America has called gold the “Last Safe Haven.” Such unilateral praise is rare for a non-interest-bearing alternative asset. But 2024 has been a year mired in uncertainty, volatility, and risk which has fueled gold demand.

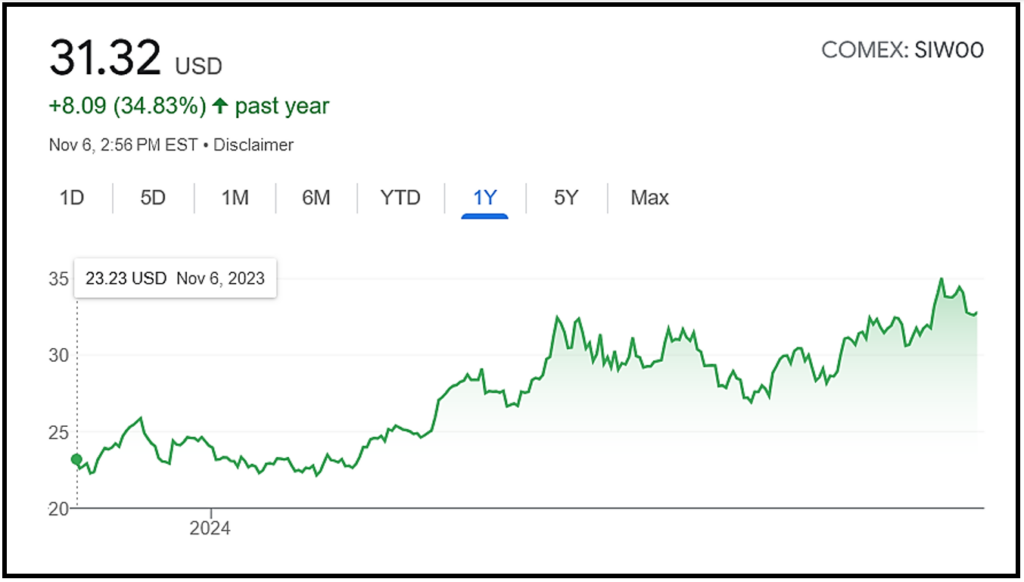

It may come as a surprise to learn that silver has also broken records as it recently hit a 12-year high and is currently outperforming gold. There are no rousing headlines touting silver’s stellar performance, however, and some investors want to keep it that way. According to Marketwatch, silver prices are poised to break out.

“Gold, with its rise to record highs this year, deserves attention — but so does its sister metal, silver, which has outperformed the yellow metal so far this year and may be gearing up for a significant rally that lifts prices toward all-time highs.”1

While often dubbed “poor man’s gold,” silver has its own history as a currency, a medium of exchange, and a monetary standard dating back centuries.

It’s an extremely valuable commodity in its own right and played a pivotal role in the development and standardization of money as we know it.

Yes, there was a Silver Standard

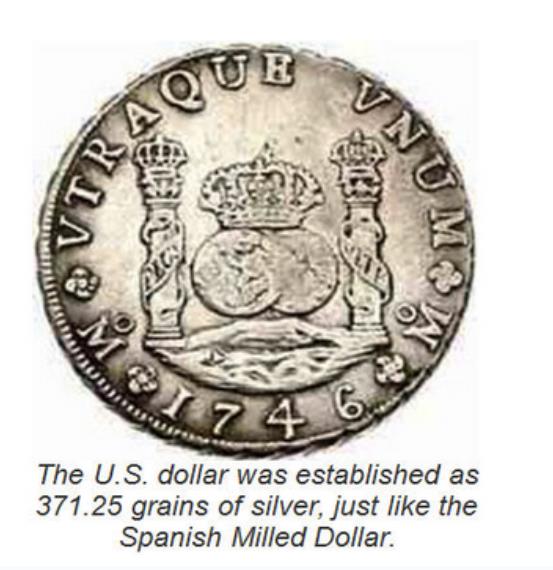

Did you know that silver was the world’s first reserve currency? There was, in fact, a silver standard dating back to “the New World” or the period associated with the late 15th and early 16th centuries. According to Kinesis Money, the silver standard was a monetary system based on the Spanish Dollar, which was widely used throughout Europe, the far East, and the Americas for close to four hundred years.2

As a matter of fact, silver coins were most often used in commerce from ancient times through the high Middle Ages and into the Renaissance Era. Silver was an ideal form of money since it was readily available and quite easy to fabricate into coins.

“In the early modern period, a coin of silver made in the New World was the base on which prices and exchange rates were established in far distant places as Leghron, Smyrna, Kingston, Bourbon Island, Surat, Manila, Macao, Cadiz, Havana, Lima, Philadelphia, Buenos Aires, and Bantam. Equally well known to Cotton Mother and to Alexander Hamilton or to the Mughal in Agra and Louis XIV of France, the Spanish American silver coin changed names and some features throughout the 16th, 17th and 18th century but remained the most successful world money before the 19th century.”3

The Coin Act of 1792 authorized the establishment of a United States Mint and the regulation of all U.S. circulating coins. It also established the dollar as a unit of currency and according to Mining.com, it defined the dollar in terms of silver. “Specifically, a dollar was to be 371.25 grains (equivalent to about three-fourths of an ounce) of silver, in harmony with the Spanish milled dollar.”4

So, the U.S. dollar was first pegged to silver, not gold. The U.S. was on the silver standard from 1792 to 1834. And, the genesis of “legal tender” in America is, in actuality, a story about silver, a soft and malleable metal that is lustrous in appearance and has a host of chemical properties and a variety of very important industrial uses.

The Dual Demand Driving Silver Prices

While silver has been used since ancient times in coinage, jewelry, figurines, food vessels, medicine, and water purification — it has an astonishing array of applications in the modern world as well.

According to the Royal Society of Chemistry, since silver is the best reflector of visible light known to man — it is often used to make mirrors. It is also used in soldering and brazing to join metals and used in batteries, photography, electrical contacts, dental alloys, medical equipment, paints, digital photography, and printed circuits.5

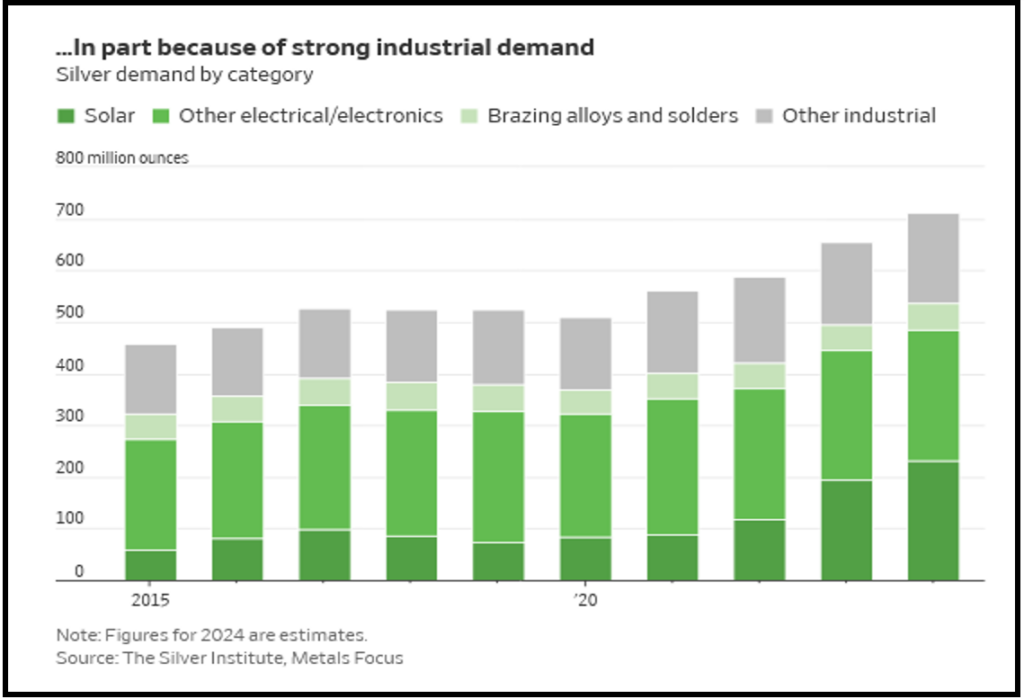

Silver’s dual role as an investment metal and an industrial metal creates two sources of demand. Aside from being an investment-grade precious metal that can be acquired as a safe haven and a hedge against inflation, it has endless uses in industrial fabrication, electronic componentry, the automotive sector, and has become a critical component of the global drive toward renewable energy. Silver demand is rising along with the world’s voracious appetite for solar energy industry.

“A booming solar-power industry is driving a surge in the demand for silver, which is needed in large quantities to make photovoltaic panels. Silver is integral to the production of solar photovoltaic—or solar PV—panels because of its high electrical conductivity, thermal efficiency and optical reflectivity, and mining companies are aiming to boost output as prices for the precious metal have climbed to decade highs. Global investment in solar PV manufacturing more than doubled last year to around $80 billion, accounting for around 40% of global investment in clean-technology manufacturing.”6

Silver is a vital component of solar photovoltaic (PV) panels. According to solar recycling company, We Recycle Solar, the average solar panel can use up to 20 grams of silver, “There’s a silver paste in the solar photovoltaic (PV) cells that collects the electrons generated when the sunlight hits the panel. Because of silver’s high conductivity, it maximally converts sunlight into electricity.”7

According to The Silver Institute demand for silver has been outrunning supply for the past three years, and it projects another deficit this year.

Citi Research, which assumes that solar-sector demand has been even higher, calculates that the market has been in deficit for the past five years.8 This supply and demand dynamic makes a bullish case for silver, giving this dual industrial and precious metal significant upside price potential.

What is the price outlook for silver?

Investors who embrace gold’s sound money and safe haven attributes, should not overlook silver. It is considerably less expensive than gold — and its robust industrial demand, supply concerns, and vital role in green energy applications bode well for a price breakout.

JP Morgan is bullish on both gold and silver:

“Across all metals, we have the highest conviction on a bullish medium-term forecast for both gold and silver over the course of 2024 and into the first half of 2025, though timing an entry will continue to be critical,” said Gregory Shearer, Head of Base and Precious Metals Strategy at J.P. Morgan.”9

Investing Haven expects silver to close in on $50/oz next year and take off from there:

“On October 18th, 2024, silver confirmed its breakout. Our silver price forecast of $34.70 will be crushed. Silver will touch $37.70 in 2024. Moreover, silver’s move to $50 is now confirmed.”10

Silver price predictions for 2025, 2026, through 2030:

- 2025: silver price touches $49.

- 2026: silver consolidation around $50.

- 2027: silver moves closer to $77.

- 2030: peak silver price prediction $82.11

Meanwhile online trading provider IG International, makes the case for $100/oz silver based on the historic price relationship between gold and silver:

“The gold-to-silver ratio is another metric often cited by silver bulls. Historically, this ratio has averaged around 60:1, meaning it takes about 60 ounces of silver to buy one ounce of gold. In recent years, this ratio has been significantly higher, sometimes exceeding 100:1. Proponents argue that as this ratio normalises, silver prices could see substantial gains.”12

While gold has been garnering headlines for its record-setting run — silver is having its own a “golden” moment. It has quietly outperformed the yellow metal over the past year, and there’s strong evidence that its price trajectory will rise into 2025 and beyond.

Savvy investors are capitalizing on silver’s low price of entry, multi-demand drivers, and growing industrial and alternative energy applications which make it a good precious metal to hold in both a strong economy as well as during periods of slowing economic growth.

This article was brought to you by Orion Metal Exchange, a top-rated precious metals dealer with “live” product pricing, full price transparency, and best-in-class customer service.

Call now for a FREE Investor Kit and up to $20,000 in FREE metals on qualifying purchases: 1-800-559-0088

- https://www.marketwatch.com/story/silver-has-been-outperforming-gold-this-year-and-may-rise-to-its-own-record-highs-47c84ff9 ↩︎

- https://kinesis.money/blog/silver/silver-standard-worlds-first-reserve-currency/ ↩︎

- https://eprints.lse.ac.uk/119883/1/The_rise_and_decline_of_the_global_silver_standard_LSE_002_.pdf ↩︎

- https://www.mining.com/web/the-forgotten-history-and-potential-future-of-silver-as-money/ ↩︎

- https://www.rsc.org/periodic-table/element/47/silver ↩︎

- https://www.wsj.com/articles/the-global-solar-power-boom-is-driving-a-surge-in-silver-demand-4ac20435 ↩︎

- https://werecyclesolar.com/how-much-silver-is-used-in-solar-panels/ ↩︎

- https://www.wsj.com/finance/commodities-futures/why-silver-is-having-a-golden-moment-bf91bb17 ↩︎

- https://www.jpmorgan.com/insights/global-research/outlook/market-outlook ↩︎

- https://investinghaven.com/forecasts/silver-price-forecast-2024/ ↩︎

- https://investinghaven.com/forecasts/silver-price-prediction ↩︎

- https://www.ig.com/en/news-and-trade-ideas/silver-price-predictions–what-s-next-for-the-precious-metal–240920 ↩︎