A Comprehensive History of Investments

Investments have long been a part of civilization, with records dating as far back as the ancient Roman and Greek empires. Over time, they have evolved and diversified, with new investment vehicles and strategies emerging in response to changing economic and social conditions.

In this article, we provide a comprehensive history of investments, where we explore the origins and the major developments, events, and trends that led to the investment landscape we see today.

Origins of Investments

In its earliest form, investments can be associated with the risk/reward decisions made by prehistoric settlers to trade over long distances in the Middle East.

As early as 8500 BCE, these settlers would trade sheep, wheat, and obsidian over long distances with the people of the Zagros-Taurus arc in what is now modern-day Turkey. Their risky commercial treks in pursuit of trade and economic profit can easily be considered as the origins of investments.

A few thousand years later, precious metals like gold would become the go-to investment for people, because these precious metals were widely accepted as a store of value by everyone.

Ancient Investments

Ancient civilizations like the Romans and Greeks were matured economies of their time with a deeper understanding of investing and trading. Their people would regularly invest in land, agriculture, and other assets like cattle and precious metals.

In contrast, the Chinese were known to invest in things like silk and porcelain, as these were highly valuable assets that could be traded for any number of things. However, investments as we know them today would not emerge until the 17th century.

The Birth of Modern-Day Investments

In 1602, the Dutch East India Company was formed as the first joint stock company in history. It is widely considered as the first truly multinational corporation that was publicly listed on the Amsterdam Stock Exchange, the first stock market of the world.

The company allowed investors to purchase shares, and receive a portion of the profits in return. This was the beginning of the stock market, which allowed people to buy and sell shares of companies.

Despite being the oldest stock market over 400 years old, the Amsterdam Stock Exchange operated on the same basic principles of investing and trading as modern stock markets do today.

The Industrial Revolution

The Industrial Revolution brought rapid development of new technologies and manufacturing processes; 18th and 19th century investors would invest in companies that produced goods and services more efficiently than ever.

This meant greater profits in a rising economy. It led to the emergence of corporations, and with it, the development of investment products like stocks and bonds. However, investing during this time was largely limited to the wealthy, as the average person did not have enough wealth, knowledge, or access to invest.

The Rise of Wall Street

No comprehensive history of investments would be complete without the mention of Wall Street.

In the early 19th century Wall Street quickly became the center of the financial world. The New York Stock Exchange had recently been founded in 1792, which allowed investors to trade stocks and bonds with ease.

This created a new level of liquidity for investors, making it easier to buy and sell securities at scale. Investing was no longer limited to the wealthy, and average Americans could start investing with very little capital.

The Great Depression

The next big events in the history of investments were the stock market crash of 1929 and the ensuing Great Depression. Bond prices soared and bond yields came down sharply. People had very little money to survive, let alone to invest.

Many investors lost trust in the New York Stock Exchange. Eventually, the government stepped in and The Securities Act of 1933 was passed to regulate the sale of securities and protect investors from fraud.

Later, The Securities Exchange Act of 1934 created the Securities and Exchange Commission (SEC) to enforce securities laws and regulate the securities industry in the United States.

Post-War Boom

After World War II, the United States experienced a period of healthy economic growth and prosperity known as the post-war boom. The 40s and 50s saw the rise of modern investment vehicles such as mutual funds and real estate investment trusts (REITs).

Mutual funds would allow investors to pool their money together to invest in gold to make money in a diversified portfolio of securities. Whereas REITs would allow investors to invest in real estate without actually owning any property themselves.

With the economy booming, the post-war era saw a steady rise in investors. For the first time, average Americans had enough disposable income, financial knowledge, and access to invest in the stock market.

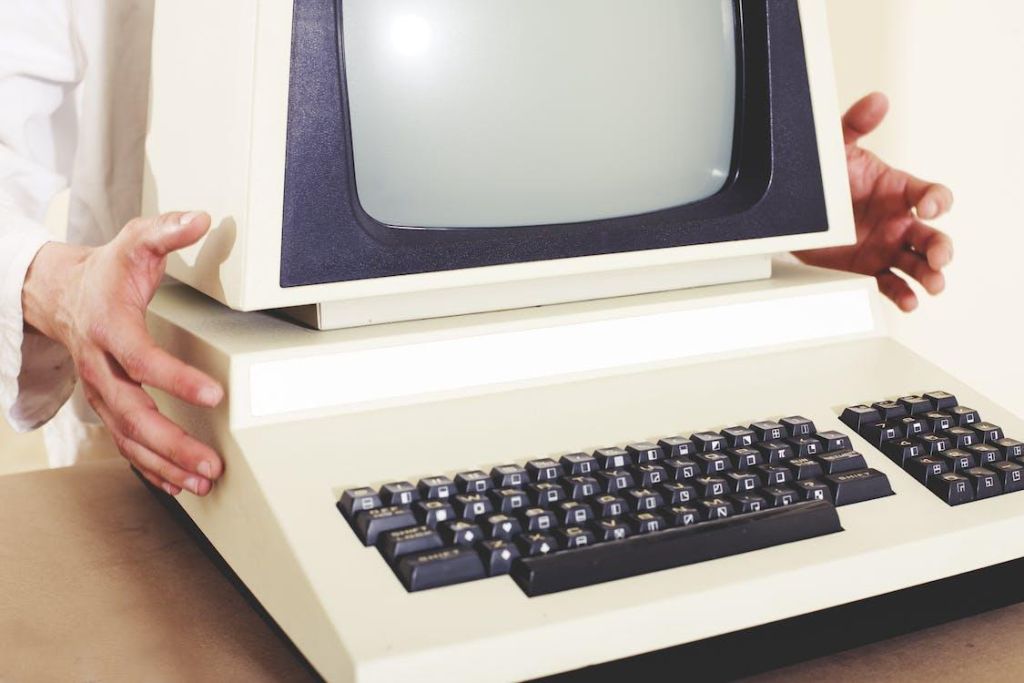

Computers & the Dot-Com Bubble

The 80s and 90s brought about significant changes in the investment world, largely due to emerging technologies. Advanced computers and the introduction of the internet made it easier for investors to access information, financial markets, and trade at record speeds.

Online trading emerged and offered great convenience because it allowed investors to trade securities from the comfort of their homes. In the history of investments, computers and the internet were the biggest technological advancements yet.

By the late 90s and early 2000s, the technology sector had shown great promise. This led to a wave of extreme speculation in internet-based companies, appropriately named the dot-com bubble.

Many investors invested in online “dot-com” companies, hoping to turn a quick profit. However, what these investors didn’t know was that most of these companies were overvalued and would eventually collapse, leading to a significant market correction.

The 2008 Financial Crisis

The 2008 financial crisis is arguably the most significant event in the history of investments.

Factors like the collapse of the housing market, subprime mortgage crisis, and the failure of several large financial institutions led to the financial crisis.

It saw many investors lose a significant portion of their portfolio, while millions of Americans lost their homes to mortgage foreclosures.

The Global Pandemic & Crypto Boom

Most recently, the global pandemic nearly halted all business around the world, resulting in global economic turmoil, the effects of which are ongoing.

Several companies collapsed and trade and investment were severely disrupted due to the lockdown of major cities and global financial hubs.

Stock markets around the world experienced severe decline, and millions of people lost their jobs.

This had a huge impact on investments, as people started realizing the fragility of job markets and how long-term passive investments can be a boon to their financial stability.

A year into the pandemic, the e-commerce industry saw unprecedented growth and many investors also turned to alternative investments such as cryptocurrencies.

These virtual currencies are backed by blockchain technology, which created a new asset class for investors. The pandemic gave rise to the crypto economy, a sector that had been on the fringes of the investment world for decades.

While increasingly popular for their sharp growth in value, cryptocurrencies remain risky, volatile investments.

Investing Today

Today, investors have access to a wide range of investment vehicles, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and alternative investments like crypto assets.

The development of robo-advisors and other technology has made it easier for investors to manage their investments and make informed decisions. A significant modern trend these days is the focus on socially responsible investing.

It involves investing in companies that align with an investor’s values, to prioritize sustainability and fair trade.

This trend has led to the emergence of ESG (environmental, social, and governance) investing, which accounts for a company’s environmental and social impact, as well as its governance practices, when making investment decisions.

Another trend that has remained popular since the pandemic is that of passive investing, which involves investing in index funds or ETFs that track a particular sector or market.

Conclusion

Investing has come a long way since its origins in the prehistoric Middle East and ancient civilizations of Greece and Rome.

While the basic principles of stock markets remain the same as they were a few centuries ago, technological advancements have changed the investment landscape dramatically.

The rise of Wall Street and new investment vehicles have made investments accessible for the masses, whereas notable events like the Great Depression gave birth to regulations for investor protection.

The history of investments is filled with challenges, lessons, and innovative solutions, many of which are relatively young.

Most recently, events like the 2008 financial crisis and the pandemic have shaped modern investments and given rise to new asset classes and strategies.

Today, investors have easy access to a wide range of investment options, and plenty of tools and strategies that make it easier for them to manage and grow their portfolios.

Still, investing remains a complex and ever-changing field, making it important for precious metals investment dealer to stay up to date.