Boomers Are Holding Too Much Stock! Gold Can Reduce Retirement Risk

Mark Twain claimed that “too much of anything is bad.” This is a similar sentiment to “excess can be harmful” and not too far removed from Aristotle’s notion that “balance is a virtue.”

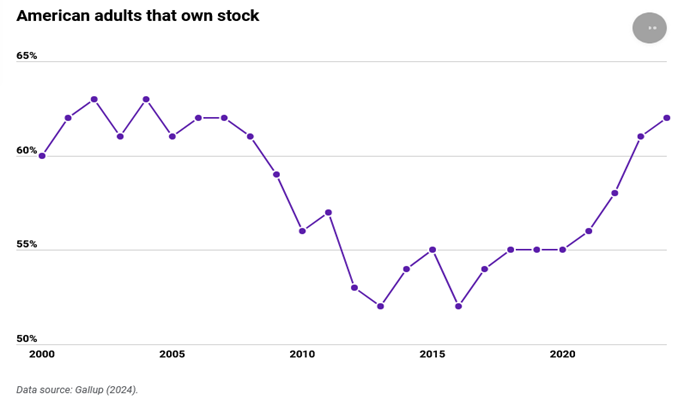

When it comes to investing, however, Americans have a lot of wealth concentrated in one place — namely the stock market. Gallup estimates that 61% of Americans now own stock, the highest level since 2008 and this includes individual stocks as well as those held in a mutual fund, 401(k), or IRA.

Baby boomers have the most “eggs” in one “basket” and by all accounts are dangerously overleveraged in equities with an estimated 30% holding all their assets in stocks and more than half holding up to 70% in stocks. According to Forbes, this myopic approach to asset allocation can leave boomers extremely vulnerable:

“You need diversification to minimize investment risk. If we had perfect knowledge of the future, everyone could simply pick one investment that would perform perfectly for as long as needed. Since the future is highly uncertain and markets are always changing, we diversify our investments among different companies and assets that are not exposed to the same risks.”

Trapped in Fear and Stress

Due to historic gains in both the housing and stock market, boomers are now the wealthiest generation in history, but they are also the most at risk of sudden financial ruin. Retirees and pre-retirees not only have a limited investment horizon, but less time to recover from unforeseen stock losses — leaving them exposed to a market decline or correction.

VettaFi, a data analytics and thought leadership company, offers a sobering reality check on baby boomers going ‘all in’ on the current bull market:

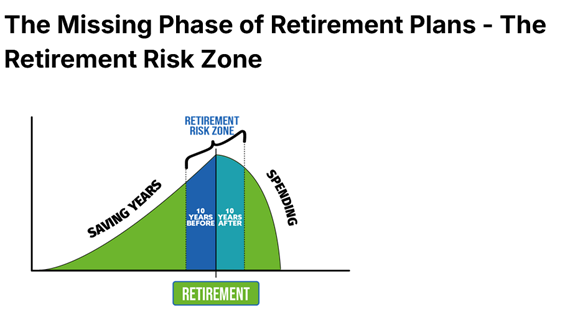

“No one knows how long the next stock market crash will last nor how long it will take to recover from that crash. We do know that the past 15 years of rising stock markets is the longest bull market ever and that stock prices are at all-time highs. And we also know that there has never been 78 million people in the Retirement Risk Zone at the same time – these are the baby boomers.”

The Retirement Risk Zone comprises the critical years right before and after retirement and according to Peak Financial Planning, it’s the most important phase of retirement planning because “you can’t go back in time” and if you’re not prepared “you can be trapped in a position of fear and stress.”

Diversification is Key

Fidelity outlines the importance of balancing a portfolio’s risk/reward profile by diversifying assets:

“Diversification is the practice of spreading your investments around so that your exposure to any one type of asset is limited. This practice is designed to help reduce the volatility of your portfolio over time.”

Indeed, diversification reduces the impact of market fluctuation and economic uncertainty with respect to savings and retirement accounts. It is one of Kiplinger’s “Six Essential Retirement Strategies for Baby Boomers” and according to Investopedia, it is particularly critical for older investors “who need to preserve wealth toward the end of their professional careers.”

Ed Cofrancesco, the President of International Assets Advisory, gives boomers a history lesson as well as a reality check, “we’ve had real-life examples of the risks, like the tech-bubble bust and the market crash of ’07 to ’09, where if you lose 50%, you needed a 100% gain to get back to square one. And how realistic is that in a short period?”

Gold is a Powerful Diversifier and More

Gold is considered a reliable portfolio diversifier due to its low correlation to traditional assets like stocks and bonds. It also has no counter-party risk meaning no company, bank, or financial entity can default on gold since it has intrinsic value.

State Street Advisors makes the case for holding gold as follows:

“Over the long term, gold stands out as a persevering source of portfolio diversification — a major reason why multi-asset portfolio managers can consider including gold in their portfolio’s allocations. Gold’s diverse, global demand among both cyclical and countercyclical sectors can help drive two key strategic benefits for portfolios: its persistently low correlations to other asset classes and its ability to protect against tail risks. These characteristics may aid in providing efficient portfolio diversification while reducing portfolio drawdowns and volatility resulting in improved risk-adjusted portfolio performance.”

Gold has also long been considered an inflation hedge since it holds its value when currencies depreciate. In other words, when the dollar declines, gold tends to rally since it is priced in dollars. In addition, inflation often triggers interest rate hikes, as we saw last month, and this provides further support to gold prices. And let’s not forget that gold is also a physical asset in limited supply which, in turn, makes it highly liquid.

Boomers Must Reduce Risk to Preserve Wealth

In the current economic climate, baby boomers must be crisis aware and risk averse, and gold’s safe haven qualities provide a much-needed hedge. It performs well during periods of financial uncertainty, economic weakness, and global chaos.

Baby boomers know all too well that any number of domestic or world events can rattle Wall Street and sabotage their retirement including foreign conflicts, pandemics, terror attacks, a housing collapse, a banking crisis, and any combination of corporate bankruptcies.

So, boomers that are overleveraged in stocks — are overleveraged in risk, and adding gold to their asset mix can help protect their retirement accounts and preserve their wealth.

This article was brought to you by Orion Metal Exchange, a top-rated precious metals dealer with “live” product pricing, full price transparency and best-in-class customer service. A precious metals expert is standing by at: 1-800-559-0088