How did the Covid-19 Crisis Affect Gold Prices?

Uncertainty might not be the best ingredient to fuel an economy’s growth, but it’s certainly suitable for some precious metals such as gold. Gold has been an old friend of investors and financially sound individuals throughout recent American history.

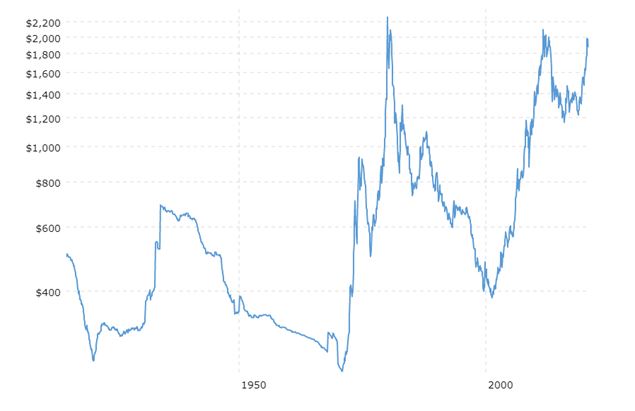

Gold witnessed a rise in value whenever a recession or natural disaster struck the country. The chart below shows the price of gold skyrocketed during the late 1920s and early 1930s during the Great Depression when most investors lost their earning in the Wall Street crash.

After this, gold prices continued to rise and reached the $2000 mark but then as the economy and global politics started to smoothen out the price of gold started to fall.

But then, with the turn of the century, the price started to rise again, eventually leading to the 2008 recession, when again uncertainty was high; thus, gold prices rose back up again.

Gold in 2020

Now that we have understood the impact that uncertainty has on the investor’s sentiments and prices of gold, let’s see how the shining precious metal performed during the current pandemic.

At the beginning of the year, the prices of gold were stable as most people expected it to rise slightly due to the upcoming election, but as the pandemic struck and most production facilities and consumer markets started to close, investor sentiments changes, and the price of gold started to rise from March.

What’s to come ahead?

This trend of rising gold prices is expected to continue till 2021 because experts see only two options for economies in the wake of this pandemic, one is to let the economy play on its own and drive itself into a full-blown recession in 2021 or the wealthy economies of the world can continue on providing stimulus packages to the consumers and sustain the economy that way.

Both options are not great to boost investor confidence in the local markets and economy, which means gold is expected to rise and stay well above the $2000 mark in the coming year as the dollar suffers due to inflation and poor economic conditions.

By now, the only questions reaching the minds of financially sound individuals like you must be how to secure your financial future in these uncertain times?

How to invest in gold? Can you buy gold bullion online? Or what are the top Gold IRA companies? Well, we’ve got you covered!

Orion Metal Exchange is a 50-year-old trusted industry veteran that has a wide variety of gold coins and some of the best gold IRA companies and their plans.

Call now at 1-800-559-0088 to learn more about our services!