How Precious Metals Are Performing During the Russian Invasion

The world hadn’t fully recovered from supply chain disruptions before Russia attempted to invade Ukraine. The world is now bracing for another catastrophe in terms of economic uncertainty, broken supply chains, rising inflations, and fluctuating currencies.

In times like this, assets usually start losing value. However, precious metals are an investment asset made for times like these. Let’s take a look at how precious metals have performed during the Russian invasion.

Palladium Prices Skyrocket

Palladium is one of the rarest precious metals in the world. It’s usually found alloyed with platinum or sometimes gold. Russia is a major supplier of palladium and holds approximately 45% of the world palladium supply. With the ongoing war and the international sanctions on Russia, palladium supplies are cut short.

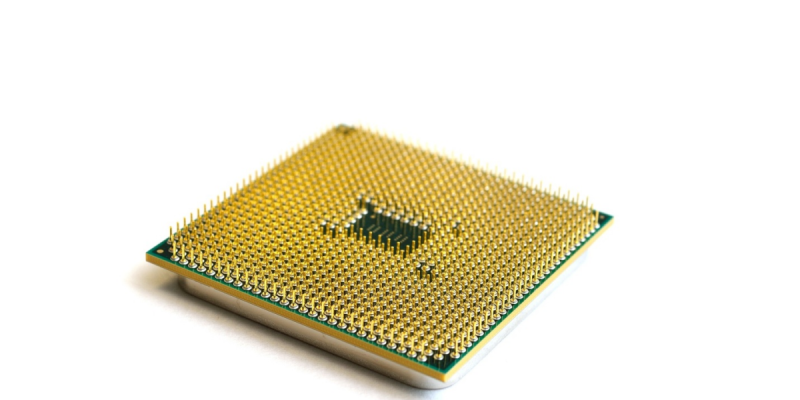

Palladium is the main component in semiconductor chips for car control sensors. Shortages of these semiconductor chips have caused disruptions in automobile manufacturing and the demand for palladium has risen at the same time, making its value go up. Back in March, palladium was trading at a record high of $3440.18 per troy ounce.

Gold Prices Go Up

Palladium wasn’t the only metal that gained value due to the conflict. Gold prices also soared. This is because Russia is the third largest supplier of gold and supplies approximately 330 tonnes every year.

Gold also has multiple applications. It’s a good conductor and is used in electronic appliances, relays, connection strips, soldered joints, and connecting wires. At the start of the year, gold was trading at $1827.89 before the war started, and it rose to 1993.85 per troy ounce.

Should You Invest in Precious Metals?

With major supply chain disruptions in almost every industry due to the ongoing conflict, experts predict precious metal prices will skyrocket even further. However, these prices are artificially inflated, which means they will come down at some point the supply chain issues are resolved or the conflict ends.

These conditions are best for short-term investments. If you plan to invest in precious metals for short-term profit, reach out to us.

Orion Metal Exchange is a precious metal investment company, and we trade on the American Eagle Exchange. We offer gold, silver, platinum, and palladium bullion bars and coins for investment purposes.

We also provide insured home delivery for your precious metals and secure vault storage if you want us to hold them. Contact us now for more information today!