How were the Platinum and Palladium Markets Affected by the Pandemic?

COVID-19’s effects still haunt businesses and the world economy. One of the safe investment options during these testing times was precious metals. Gold and silver acted as a hedge against the crumbling economy and rising inflation, but how were other precious metal markets affected?

In this blog, let’s take a look at how the pandemic affected the platinum and palladium market.

Change in Supply and Demand

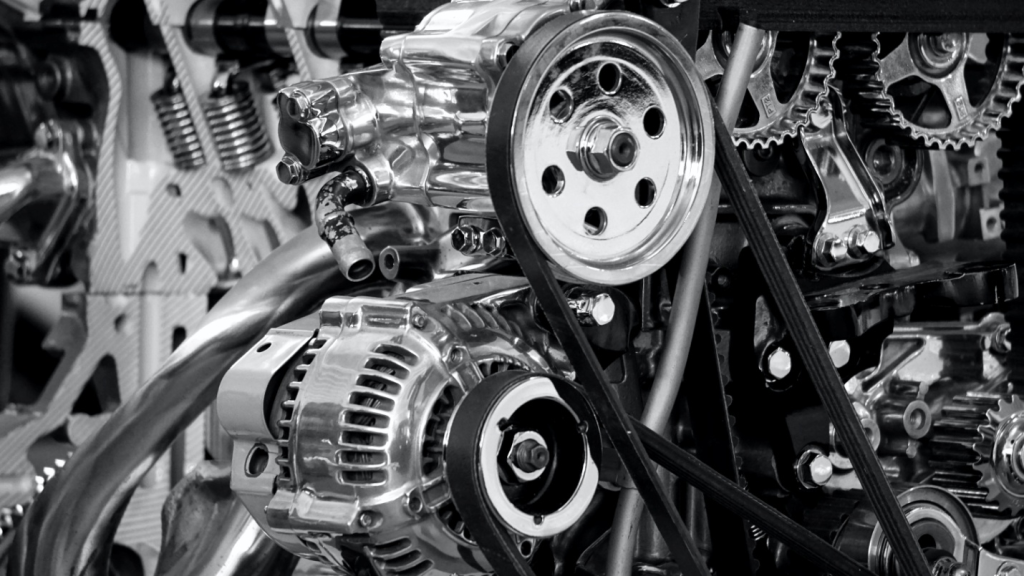

Platinum supply fell by 20% in 2020 due to the pandemic, making the demand go up. In reaction, car production fell by around 18%. Palladium prices also skyrocketed due to low supply, with an ounce of Palladium going from 800 dollars in 2018 to 2875 dollars in 2020.

Additionally, demand for cars decreased by 13%, as per statistics. This is because shortage of platinum and palladium led to a decrease in car production. Auto manufacturers hiked car prices to make up for low production, making new cars unaffordable for many people and causing a drop in demand.

Surge in Sales

On the other hand, platinum and palladium bar sales went up in the pandemic due to their relation to gold. Gold is inversely related to the US dollar. When the economy crashed, gold got stronger and was trading at its highest value in 2020, which is 2067 dollars per troy ounce.

Industrialists like auto manufacturers took advantage of this by buying platinum and palladium in bulk before the surge in prices on the Shanghai Gold Exchange (SGE). The demand for platinum and palladium bars and coins increased in the US as well.

As per statistics, platinum sales dropped by 2.5% but palladium sales increased by 1.7% in the United States.

Future Prices

Even though the recent price, supply, and demand changes in platinum and palladium were due to the pandemic, it’s yet not known how the market will behave once the effects of the pandemic go away completely.

Recently, the prices have stayed stable and platinum and palladium, along with other traditional metals, are being traded at higher prices on average than before the pandemic. This means that it’s definitely worth it to invest in platinum and palladium. If you’re looking for a reliable precious metal storage companies, Orion Metal Exchange can help you.

We offer gold, silver, platinum, and palladium as precious metal investment options. We also provide secure private vault storage and precious metals IRA consultation. For further information, contact us right away.