No Matter Who Wins the White House, Gold Will Win the Next Four Years

It’s an election year and the past four presidential elections — dating clear back to the beginning of the millennium — suggest that gold will continue its record-setting run no matter who wins in November!

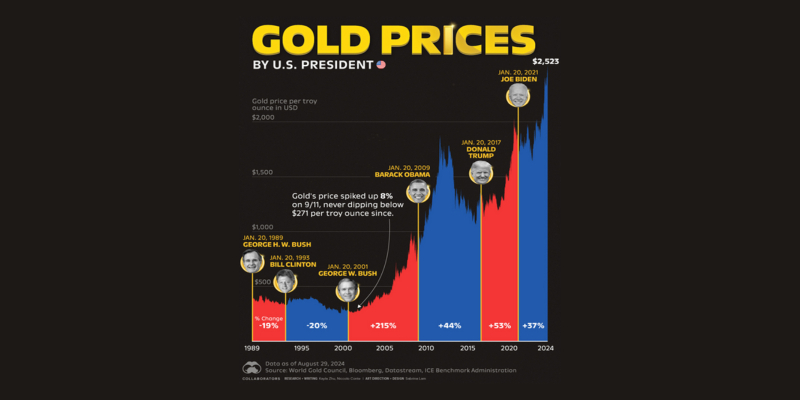

According to data from Visual Capitalist, for the past 24 years, gold prices have risen regardless of who occupies the White House.

The price of gold catapulted 215% during George W. Bush’s (R) tenure fueled by the September 11, 2001 terrorist attacks and the economic damage that followed. Prices rose another 44% during Barack Obama’s (D) presidency who took office at the start of the Great Recession. Gold prices advanced 53% during the Trump Presidency (R) due to the fallout from Covid and the global economic collapse precipitated by business closures and lockdowns. And gold is currently up over 40% during the Biden presidency (D), hitting multiple all-time highs as inflation and geopolitical tensions have been significant drivers of gold demand in light of its safe haven appeal.

The Threat of Recession

The outlook for gold into 2025 and beyond is universally bullish and one of the primary reasons is the risk of a recession. CNN economics reporter Elizabeth Buchwald points out that the Fed’s recent rate cut projections may not translate to clear economic skies ahead, at least according to history:

“Oftentimes, the Fed cuts interest rates because it expects economic conditions will worsen drastically in the near future and it wants to preemptively soften the blow, knowing it sometimes can’t prevent a recession altogether. So, in that regard, it shouldn’t be too shocking that recessions frequently begin after the Fed cuts rates.”

In addition, Torsten Slok, the chief economist at Apollo Global Management conducted an historical comparative of previous Fed easing cycles and found that the Fed’s September 18th jumbo rate cut is much more suggestive of a recessionary cycle than a non-recessionary cycle. “Despite surveys showing that the consensus is expecting a soft landing, rates markets are pricing in a full-blown recession,” he said.

Oanda, a leading forex broker suggests that gold could rise well over $3800/oz over the next five years with some models suggesting it to surge as high as $5600/oz based on “the continuation of current trends in real income growth, fiscal imbalances, and geopolitical risks, all of which are likely to sustain strong demand for gold.”

Robust Central Banks Purchases

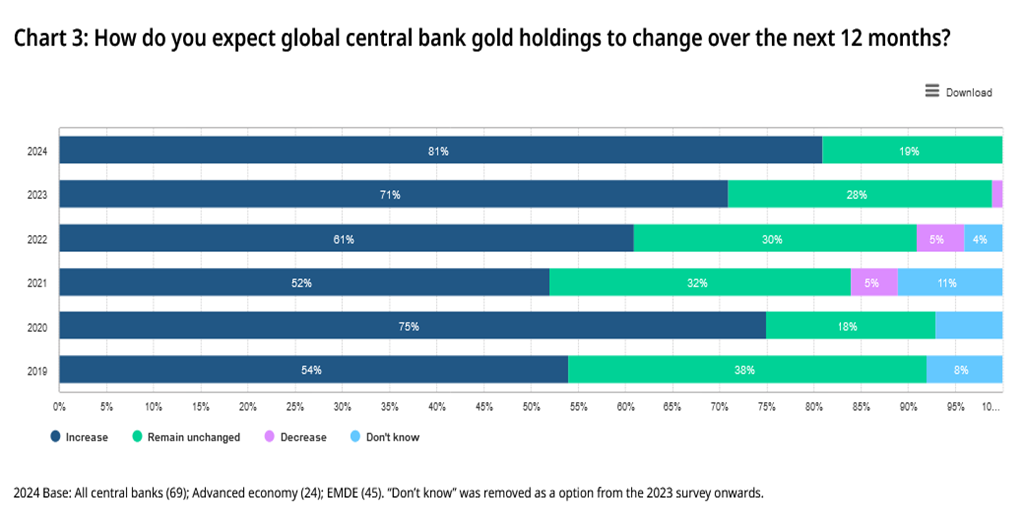

After two record-setting years of gold purchases, central banks continue to drive gold demand. In the World Gold Council’s 2024 Central Bank Gold Reserves Survey, when 69 banks were queried about the outlook for central bank holdings over the next year, a staggering 81% expected them to increase.

According the World Gold Council’s CEO, David Tait, while China’s central bank has pulled back after 18 consecutive months of aggressive buying, he expects smaller banks to take up the slack.

“I do think that they central bank demand for gold will continue, and I think it will be largely driven by developing central banks. Their gold reserves as a portion of their reserves are still very low by Western standards. I expect them to accumulate more than any other.”

In support of their optimistic gold price forecast, Goldman Sachs points to continued aggressive central bank buying as one of the key factors that they believe will drive higher gold prices into 2025.

“Since Russia’s invasion of Ukraine in 2022, central banks have been buying gold at a brisk pace — roughly triple the amount prior. Goldman Sachs Research expects the buying spree to persist amid concerns about US financial sanctions and the growing US sovereign debt burden.”

A World at War

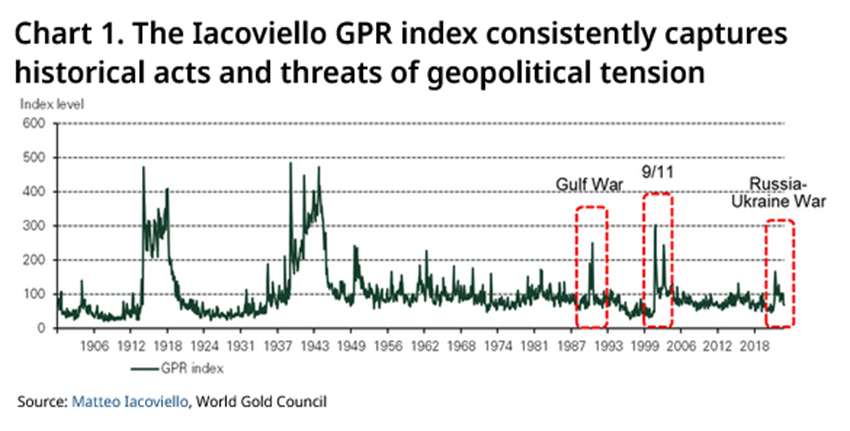

Gold has a longstanding reputation as a chaos hedge and much like the attacks of September 11th, the subprime mortgage collapse of 2008, and the disruption of the global pandemic — the Russia-Ukraine War and the Israel-Hamas War are highly de-stabilizing events that have made gold an attractive store of value for investors.

According to the World Gold Council, geopolitical risk can be quantified. The Geopolitical Risk (GPR) index developed by Matteo Iacoviello measures actual and perceived geopolitical tension. And as a go-to crisis asset, gold has a positive correlation to any high-risk global event.

Jason Katz, a managing director at UBS, believes gold has further to run due to all that is “transpiring in the Middle East” along with unprecedented U.S. election uncertainty. Katz says gold could appreciate by up to 7%.

A recent post on social and financial platform, Talk Markets, reiterated the impact of the daily clashes between Israel and Hezbollah on gold prices:

“The ongoing geopolitical tensions, including the exchange of heavy fire between Hezbollah and Israel, have created significant uncertainty in the global markets. Historically, these conflicts have driven investors towards gold. The intensified violence has prompted a flight to safety, pushing the gold price higher as demand for the metal increases during political instability.”

And, a post on FX Empire suggests that gold investors and gold demand are responding to the possibility of an all-out Middle East war. “Recent Israeli airstrikes against Hezbollah in Lebanon have added to the geopolitical risk premium, reinforcing gold’s safe-haven appeal. Investors are holding significant positions in gold, driven by fears of further escalation in the region.”

Jason Katz, a managing director at UBS, believes gold has further to run due to all that is “transpiring in the Middle East” along with unprecedented U.S. election uncertainty. Katz says gold could appreciate by up to 7%.

A recent post on social and financial platform, Talk Markets, reiterated the impact of the daily clashes between Israel and Hezbollah on gold prices:

“The ongoing geopolitical tensions, including the exchange of heavy fire between Hezbollah and Israel, have created significant uncertainty in the global markets. Historically, these conflicts have driven investors towards gold. The intensified violence has prompted a flight to safety, pushing the gold price higher as demand for the metal increases during political instability.”

And, a post on FX Empire suggests that gold investors and gold demand are responding to the possibility of an all-out Middle East war. “Recent Israeli airstrikes against Hezbollah in Lebanon have added to the geopolitical risk premium, reinforcing gold’s safe-haven appeal. Investors are holding significant positions in gold, driven by fears of further escalation in the region.”

Gold is the Projected Winner

The upcoming U.S. election is shaping up to be among the most polarized and unpredictable elections in recent memory. The 2024 race for the White House will go down in history for its wild volatility — from the last-minute withdrawal of the incumbent president (D), to the late appointment of the sitting vice-president (D) as the Democratic nominee without a single primary vote, to months and months of dangerous rhetoric followed by two assassination attempts against the Republican presidential candidate.

No matter what the outcome, the economic and global risks that have driven gold to record highs in 2024 — are poised to make gold the clear winner in November and to continue its record setting run into 2025.

This article was brought to you by the research team at Orion Metal Exchange, a top-rated precious metals dealer with LIVE gold product pricing, an easy purchase experience, and best-in-class customer service.

For more information about acquiring gold to protect your savings and retirement accounts click here. Or to receive a FREE gold investing kit click here. For immediate assistance, a precious metals expert is standing by RIGHT NOW at: 1-800-559-0088