The Beginner’s Guide to Investing in Gold

Gold has been a valuable commodity for over 5,000 years. In ancient times, gold was used as a form of currency. In the Middle Ages, people could be executed for counterfeiting gold coins. Investing in gold is a great way to diversify your portfolio and protect against inflation. The price of gold is determined by supply and demand. The more people want to buy gold, the higher the price.

Gold is rare because we only mine about 2,500 tonnes per year. When we compare that to other commodities like copper or coal mined in the tens of thousands every year, it’s easy to see why gold is so valuable.

We’ve created a brief guide for you if you’re looking to invest in gold and unsure where to start.

How to Start Investing with Gold

Gold has been a popular investment for many decades. When deciding to invest in it, there are mainly two ways: buying gold bars or coins or purchasing stocks of companies that mine gold. The first option can be done at any time, but the second option requires waiting until there’s a dividend payment before you can sell your shares and convert them into gold bullion or coins.

What are the Advantages of Investing in Gold?

People invest in gold for different reasons, but some common advantages come with gold.

Gold is considered a great asset to have because it does not depreciate like other investments do, which means that it can maintain its value over time. Another advantage of investing in gold is that it does not produce any income, so you will not have to worry about paying taxes on any money you make from the investment.

Gold also has the potential for appreciation, so if you hold onto it long enough, you could see your investment grow exponentially.

Many people invest in gold coins, but there are also other ways to invest in gold, like buying shares of mining companies, investing in gold-backed ETFs, or buying shares of companies that are heavily involved with gold mining.

What are the Disadvantages of Investing In Gold?

Investing in gold is a risky investment due to its volatility. Gold prices can go up or down depending on the global economic climate.

Gold prices are also affected by the stock market, another risk for investors in this commodity. Additionally, its prices can also be affected by the value of other commodities, such as silver and platinum.

Looking to Invest In Gold?

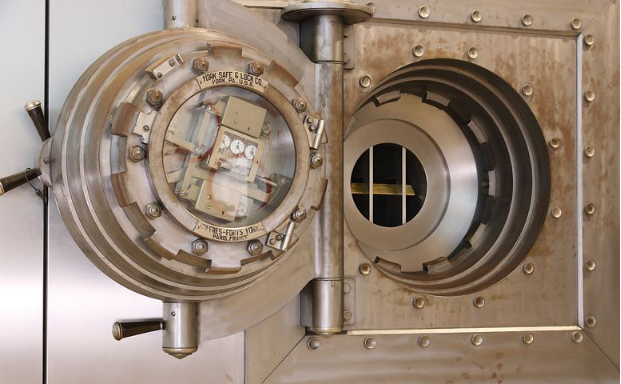

We at Orion Metal Exchange take pride in providing you with a range of precious metal storage, including gold IRA accounts and silver IRAs. We believe in respecting your wishes and giving you the security of knowing that your metals are safe. Contact us today!