The Top Four Reasons to Buy Gold

Gold has been in the news throughout 2024 and has now become one of the world’s hottest and most talked about investments. It has systematically hit multiple all-time highs, broken through key resistance trendlines, and shattered heretofore unthought of milestones, i.e. $2500/oz, $2600/oz, $2700/oz.

The precious metal is being driven by a host of factors including Fed rate cuts, election uncertainty, rising geopolitical risk, central bank purchases, stubborn inflation, the threat of currency devaluation, market risk, consumer sentiment, etc., all of which impact supply and demand.

As of this writing, gold is outperforming both the Dow Jones Industrial Average and the S&P 500 year-to-date. A recent Reuters report says Citigroup, Goldman Sachs, and JP Morgan all expect gold to extend its record-breaking rally into next year due to “a revival in large inflows to exchange-traded funds (ETFs) and expectations of additional interest rate cuts from prominent central banks around the world, including the U.S. Federal Reserve.”1

In addition to these triggers, gold has other key elements adding fuel to its fire:

1. Gold is Money

Back in 1912, banking tycoon J.P Morgan stated in testimony before Congress that, “Gold is money, and nothing else.” Indeed 112 years ago, the United States was still on the gold standard, a system in which paper money is directly linked to gold, so gold was indeed the only form of real money.2

In 1971, however, Richard Nixon ended the dollar’s convertibility to gold, giving the Federal Reserve control of the money supply. Today, the dollar is no longer backed by physical gold but is instead a free-floating “paper” currency guaranteed by the full faith and credit of the U.S. government. And like many governments throughout history, the U.S. has printed too much money, stoked inflation, manipulated interest rates, and eroded the value of the buck.3 And this has undermined public trust.

As a result, gold is still held in high regard as the only true money since it is a tangible asset with intrinsic value. It is called a “store of value” because it’s a stable asset that tends not to dramatically decline over time. Owning gold is equated with economic freedom and a necessary check on government spending and waste.

Many have called for a return to the gold standard including scholars at the Cato Institute:

“A gold standard would impose a much needed discipline on the issue of currency and on attempts to manipulate interest rates … The gold standard has a very creditable historical track record in delivering longer-term price stability, and the ultimate endorsement, to our way of thinking, is that it is anathema to monetary interventionists.”4

The gold standard actively constrained and reeled in government consequently, it’s not a popular movement in today’s Washington. But that has not stopped savvy investors from acquiring gold for the same reasons central banks do — to hold it as a hedge against a broken monetary system.

2. Gold is Strong Portfolio Diversifier

The goal of a well-diversified portfolio is to hold low-correlation assets, so when one group of assets drops in value it can be offset by resilience or gains from another. According to the World Gold Council, portfolio diversification is one of the key advantages of holding precious metals and gold, in particular, is considered a highly effective diversifier.

“Many assets become increasingly correlated as market uncertainty rises and volatility is more pronounced, driven in part by risk-on/risk-off investment decisions. As a result, many so-called diversifiers fail to protect portfolios when investors need them most.

Gold is different in that its negative correlation to equities and other risk assets increases as these assets sell off. The GFC (Global Financial Crisis) is a case in point. Equities and other risk assets tumbled in value, as did hedge funds, real estate, and most commodities, which were long deemed portfolio diversifiers.

Gold, by contrast, held its own and increased in price, rising 21% in US dollars from December 2007 to February 2009. And in the most recent sharp equity market pullbacks of 2020 and 2022, gold’s performance remained positive.”5

Incorporating a variety of investments into a financial portfolio not only helps deliver higher returns, it also reduces a portfolio risk. And while asset managers often balance portfolios with a variety of stocks, bonds, mutual funds, and cash — gold is a far superior diversifier.

It not only mitigates market risk and protects wealth, it has no counter-party risk, meaning that there are no contractual obligations, agreements, or governments that determine its value — so there’s no chance of another party defaulting on that value.

And despite the dollar’s world reserve currency status and continued dominance in international trade, gold has become the clear diversifier of choice across the globe:

“Central bank buying of gold accelerated after Russia’s invasion of Ukraine. Central banks have purchased well over two thousand tons of gold in the last two years—the fastest pace in history, according to the World Gold Council. As the yellow metal carries no credit or counter-party risk, some deem it as being better insulated from financial sanctions, particularly those from the emerging world. These institutions look set to continue accumulating gold going forward, with 81% of those polled in a recent World Gold Council survey expecting to see higher global gold holdings by central banks in the year ahead.”6

According to State Street Advisors, portfolio managers should include gold in their allocations due to “its persistently low correlations to other asset classes and its ability to protect against tail risks” to help promote efficient portfolio diversification and improve risk-adjusted portfolio performance.7

3. Gold is a Liquid Asset

Gold is easy to buy and even easier to sell. No matter what economic conditions come into play, there are always investors looking to acquire gold and others looking to sell it.

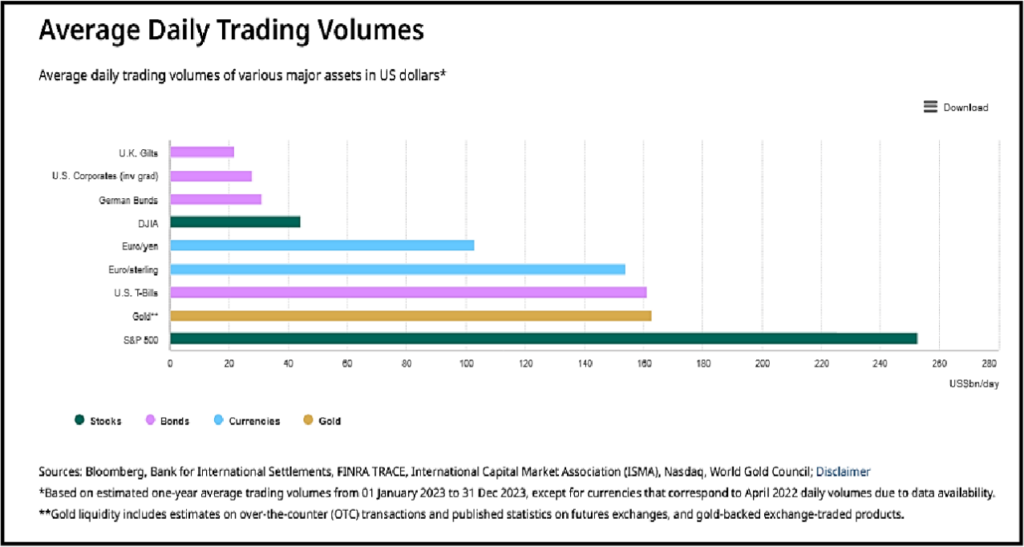

Gold is one of the most heavily traded assets in the world. A glimpse of average daily trading volumes, attest to gold’s liquidity across the global OTC, futures, and ETF markets.8 Aside from investment activity — the world jewelry market, central bank purchases, and the technology sectors also stoke gold demand. Jewelry actually represents the largest annual demand category for the gold sector.

According to Statista, gold for jewelry fabrication last year accounted for 2,168 metric tons of overall gold demand worldwide, almost double gold demand for investments.9

The London Bullion Market Association has recently collaborated with the World Gold Council to explore gold’s potential as a High-Quality Liquid Asset (HQLA) in the modern financial landscape. “This study is pivotal in reshaping the conversation around gold in regulatory and financial circles, advocating for a strategic re-evaluation of gold’s role in liquidity frameworks.”

Their interim study maintains that gold fulfills the HQLA criteria as follows:

- Fundamental Characteristics:

Gold’s high credit standing, low legal risk, and denomination in USD. - Market Characteristics:

Gold’s low volatility, negative correlation with risky assets, and active and sizable market. 10

When investors want to liquidate physical gold coins or bars, they can be sold to a reputable precious metals dealer and according to The Penny Hoarder, local jewelry stores, pawnshops, auction houses and online gold buyers will also readily purchase physical gold.11

Much like cash, physical gold is a liquid asset. It is more liquid than some of the major financial markets and easier to sell than a house, property, or a cache of stocks and bonds. Gold has broad universal appeal; it’s globally recognized and because it is an historic store of value – it will always be in demand.

4. Gold is a Safe Haven

According to Investopedia a financial safe haven is “a type of investment that is expected to retain or increase in value during times of market turbulence. Investors seek out safe havens … to limit their exposure to losses in the event of market downturns.”12

For generations, gold has been the go-to asset amid financial Armageddons, Wall Street panics, economic crises, wars, volatility, and global chaos. Its safe haven status derives from its stable value over time and its ability to protect portfolio value.

Recent hostilities between Russia and Ukraine as well as the Middle East conflicts between Israel and Hamas, Hezbollah, and Iran — have triggered a dramatic rise in gold’s safe haven demand, prompting it to reach consecutive all-time price highs.

“The precious metal has surged by more than a third this year, supported by central-bank buying and haven demand due to conflicts in the Middle East and Ukraine. The neck-and-neck US presidential election between Kamala Harris and Donald Trump that’s less than a week away is also front of mind for investors, with uncertainty over the outcome underscoring bullion’s role as a place of safety for investors.”13

According to international investment management firm, Schroders, gold may be — the only safe haven asset left.

“The current uncertainties suggest that institutions are likely to continue to give more consideration to portfolio diversifiers such as gold, as other choices look less appealing.

The cryptocurrency space, which may well have attracted capital away from gold in recent quarters, is also under increasing regulatory pressure … More broadly, it is difficult to argue that traditional hedging instruments, such as government bonds, are as appealing as they’ve been in the past, not least because economies are highly indebted, yields are still close to historical lows, and inflation could well be structurally higher … we believe that gold is well on its way to becoming the “TINA” (there is no alternative) safe haven asset in coming years.”14

Gold is undoubtedly having a moment. It has not only had a record-setting run, there seems no end in sight to its upward price potential. Gold is real money, a powerful diversifier, a highly liquid asset, and a safe haven that helps protect portfolio value, life savings, and accumulated wealth from the ongoing threat of financial shocks, market turbulence, and geopolitical uncertainty — all of which will likely remain in play for 2025.

This article was brought to you by Orion Metal Exchange, a top-rated precious metals dealer with “live” product pricing, full price transparency, and best-in-class customer service.

Call now for a FREE Investor Kit and up to $20,000 in FREE metals on qualifying purchases: 1-800-559-0088

- https://www.reuters.com/business/finance/most-banks-expect-golds-bull-run-persist-into-2025-2024-09-24/ ↩︎

- https://www.forbes.com/sites/greatspeculations/2015/06/15/history-rife-with-disastrous-consequences-from-abandoning-gold-standard/ ↩︎

- https://www.businessinsider.com/personal-finance/investing/fiat-money ↩︎

- https://www.cato.org/sites/cato.org/files/serials/files/cato-journal/2012/7/v32n2-11.pd ↩︎

- https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset/golds-key-attributes-2-diversification ↩︎

- https://www.ubs.com/global/en/wealthmanagement/insights/marketnews/article.1621092.html ↩︎

- https://www.ssga.com/library-content/products/fund-docs/etfs/us/insights-investment-ideas/spdr-invest-in-gold.pdf ↩︎

- https://www.gold.org/goldhub/data/gold-trading-volumes ↩︎

- https://www.statista.com/statistics/299603/gold-demand-by-sector/ ↩︎

- https://cdn.lbma.org.uk/downloads/LBMA-Seminar-2023-David-Gornall.pdf ↩︎

- https://www.thepennyhoarder.com/make-money/how-to-sell-your-gold/ ↩︎

- https://www.investopedia.com/terms/s/safe-haven.asp ↩︎

- https://www.bloomberg.com/news/articles/2024-10-29/gold-xauusd-hits-fresh-record-high-as-us-data-election-race-fan-demand ↩︎

- https://www.schroders.com/en-us/us/individual/insights/gold—the-only-safe-haven-asset/ ↩︎