Investing in Platinum for Beginners

Platinum is often used in the industrial and manufacturing industries, especially in automobile pollution control equipment. Since platinum is required in manufacturing, its price is projected to rise as the global economy recovers from the pandemic.

Platinum can be used as an investment in a variety of ways, including hedging and speculating. If you wish to add platinum or any other precious metal to your portfolio, you should consult with a financial expert and stay updated on the platinum market.

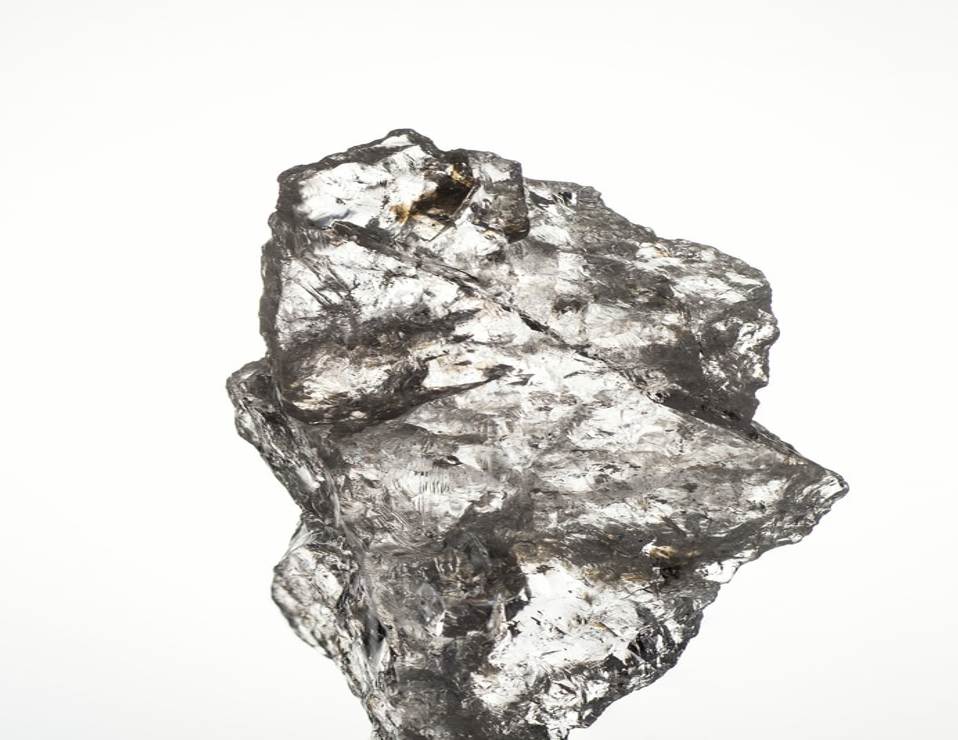

What Is Platinum?

Platinum is an inorganic compound, precious metal, and resource predominantly used to create jewelry, semiconductors, and automobiles. It is represented on the periodic table by the symbol Pt and has the atomic number 78.1. Platinum can also be purchased by acquiring shares of an exchange-traded fund.

The Platinum Industry

Platinum is a precious metal that’s related to palladium, osmium, and other metals. Platinum is thirty times rarer than gold; hence a platinum investment is more volatile than other precious metals. Even though platinum is more valuable than gold, far more gold has been mined than platinum. The automotive industry consumes between 50 to 60% of the world’s platinum and palladium production.

Platinum is used in more industrial and manufacturing applications than other metals. It’s used in the manufacture of catalytic converters, which are used to regulate pollution in automobiles. Since it’s conductible, it is employed in fuel cells and power generation. Platinum use in automobiles has increased in the United States, even though hybrid and electric vehicles don’t require catalytic converters. This is because platinum is employed in hydrogen-powered technology, often known as “green hydrogen.” Furthermore, the usage of platinum is increasing in the Asia-Pacific automotive sector.

Platinum is commonly valued for fine jewelry, particularly in India and China. It is also useful in the manufacture of flutes. Computer hard drives are coated with a platinum alloy. Platinum is even utilized in cancer treatments and has potential uses for Parkinson’s disease.

South Africa mines over 75% of the world’s platinum. Russia is the world’s second-largest producer of platinum. What’s more, some platinum is mined in Canada and the United States, primarily in Montana. Zimbabwe is home to platinum mines as well. Platinum is frequently mined as a byproduct of nickel mining.

Issues That Impact Platinum Rates

Since the platinum market is smaller than other precious metals, prices can vary rapidly. Platinum is more responsive to supply and demand than gold, as it is an industrial metal. Platinum prices are also affected by political stability. Since South Africa and Russia mine most platinum, political turmoil in these nations might disrupt supply, putting pressure on prices.

The car industry, as the main source of demand, has an impact on platinum prices. Platinum is used in autocatalysts to reduce emissions in diesel and gasoline vehicles. However, it also plays a part in the hydrogen economy, transitioning from fossil fuels to hydrogen as a primary energy source. The metal is used to generate hydrogen and fuel cells used to power automobiles and boats. As a result, demand in the automobile industry can have a variety of effects on platinum prices.

Investing in Platinum

There are four main ways to do platinum investing;

Bullion

Since platinum is one of the heavier metals, most investors cannot afford to acquire a large quantity of bullion for delivery. A 6-inch cube of platinum weighs the same as a normal-sized person, which is why it’s not feasible to move a large amount of platinum.

Bullion bars with pure platinum are produced in weights from troy ounces to kg. Platinum bars are the option for quality and reliability, protected in serialized security packaging, and stamped with a unique identification number matching the number etched in the bullion bar to act as a certificate.

Stocks And EFTs

A platinum trust is a feasible platinum investment for direct investment. Another option is to invest in a platinum mining firm. Platinum has a volatile spot price, and mining businesses are less subject to price fluctuations. Within the platinum market, ETF would provide some minor volatility.

Options

Platinum options are options that deal with a platinum futures contract as a financial commodity. A platinum option gives the holder the right to enter into a long or short position in the underlying platinum futures at the strike price. This right will expire when the option expires after the marketplace closes on the expiry date.

Futures

Investors like to take benefit of their short-term price unpredictability, whereas respondents try to balance risk. Platinum futures are commodities futures contracts in which clients agree to purchase or sell precious metals at a fixed price and on a fixed date in the future. Market makers apply platinum futures to protect their assets from market instability.

Pros Of Platinum Investing

Take a look at the main advantages of investing in platinum;

• It’s a cash-equivalent investment that can be easily redeemed.

• If the value of fiat currencies falls, the value of precious metals such as platinum, gold, and silver may rise.

• The value of gold is dependent on the value of the U.S. dollar, whereas platinum is not dependent on it. As a result, volatile changes in the value of the dollar will not affect pricing.

• It provides a buffer against inflation, economic uncertainty, and war.

• It has shown a consistent increase in the price with volatility. As a result, investors believe it to be one of the safer options.

• The increase in platinum demand in the manufacturing industries will result in a price increase in the future.

What Are the Risks of Investing in Platinum?

There are not many risks associated with investing in precious metals. However, it is still advisable to diversify their metal investments to alleviate any risk and increase your chances of success. By spreading out your investments across different types of metals, you’ll reduce the risk significantly.

Invest in Platinum Now

Platinum is valuable as it never goes out of style. They are also rare enough that their price will continue to increase over time. At Orion Metal Exchange, we facilitate investments in precious metals, such as gold, platinum, and silver coins. If you’re looking to buy platinum bullion bars and coins at the best possible price, contact us today for more information about our services. You can also email us at support@orionmetalexchange.com or request your free investor’s kit here.