Central Banks Are Buying Record Amounts of Gold for a Reason

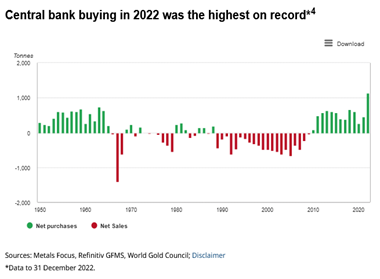

In 2022, the world’s central banks bought 1,136 tons of gold, the highest level of annual demand on record dating back to 1950, according to the World Gold Council. And in 2023, the “colossal” buying continued as central banks amassed another 1,037 tons of gold. This year, central bank demand in Q1 was 290 tons, the strongest start to any year on record.

The Big Bank Gold Grab

The world’s monetary authorities have been buying gold for centuries to increase economic stability and manage currency risk. According to the World Economic Forum, there are certain financial climates in which central banks also sell gold as in the 1990s and early 2000s:

“There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.”

But starting in 2010, the world’s banks became steady net buyers of gold due to the economic uncertainty in the aftermath of the Great Recession. And, according to Brookings, 2010 was the year that Americans “finally woke up to the fact that their federal budget was on a dangerous course, hurtling toward a debt crisis.”

Since 2010, central banks have amassed 7,800 tons of gold, 28% of which was purchased just in the last two years. This amounts to about one-fifth of the world’s total mined gold.

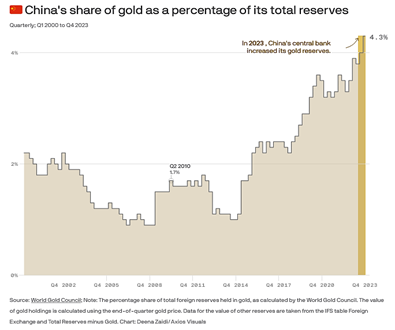

China’s Voracious Gold Appetite

The record-setting central bank gold purchases of the past few years have largely been driven by soaring inflation, increasing geopolitical tensions, and rising market worries. According to International Banker, China led the buying spree:

“2023 was a particularly colossal year for the People’s Bank of China (PBoC)-led gold splurge that was observed across the world, a year in which China’s central bank bolstered its gold purchases by a hefty 30 percent. According to the World Gold Council (WGC), central banks led by China purchased 1,037 tonnes (metric tons) of gold last year, with the PBoC buying more gold than all other central banks combined.”

Prior to pausing its purchases in May, the People Bank of China acquired gold for 18 consecutive months. China’s historic gold grab continued its efforts to reduce its dependency on the U.S. dollar, according to the Royal Mint: “The reliance on the U.S. dollar has often led to vulnerabilities, as the United States has used it currency’s dominance to impose sanctions on countries like Russia and Iran. China’s strategic move to accumulate gold assets appears to be a means of insulating its financial system from such vulnerabilities, as gold holds intrinsic value and isn’t subject to the same geopolitical pressures as fiat currencies.”

EM’s Have More Gold to Buy

While emerging markets (EMs) like China, India and Turkey are actively acquiring gold to diversify away from the dollar, the central banks of central and eastern Europe have turned to gold to protect their economies from the fallout of the Russia-Ukraine War. The National Bank of Poland, for instance, accumulated an additional 33 tons of gold from April to July of this year, while the Czech National Bank bought almost 6 tons of gold in Q2.

In addition, Arab nations like Jordan and Qatar and the Central Asian nation of Uzbekistan are ramping up gold purchases due to the widening conflicts in the Middle East as well as fears of deepening economic turmoil and the threat of a global recession.

Researchers at Gold Sachs expect central bank purchases to stay strong “on the back of reserve diversification by EMs [emerging markets] and elevated geopolitical tensions.” And they emphasize that bullion holdings in emerging markets are only about 6% of total reserves, so there’s plenty of room for developing nations to acquire more gold and further fuel demand.

Central Banks Buy Gold for the Same Reasons Investors Do

Reserve banks are tactical and strategic buyers of gold and typically acquire the precious metal either to reduce financial risk in times of crisis or to secure long-term economic stability.

Gold has traditionally been a fiscal panacea for inflation, recession, volatility, and uncertainty. It is heralded as a tangible asset and a store of value that does not depreciate, but instead retains its purchasing power — come what may. In light of the current chaos engulfing the globe, these attributes have driven gold to consecutive all-time highs, and that trajectory is unlikely to change whether the dollar is stronger or weaker, Wall Street is bullish or bearish — and no matter who controls the White House in 2025.

According to the Head of Global Commodities Strategy at JP Morgan:

“Many of the structural bullish drivers of a real asset like gold — including U.S. fiscal deficit concerns, central bank reserve diversification into gold, inflationary hedging and a fraying geopolitical landscape — have lifted prices to new all-time highs this year despite a stronger U.S. dollar and higher U.S. yields, will likely remain in place regardless of the U.S. election outcome.”

Suffice to say that central banks acquire gold for the very same reasons that savvy investors add it to their portfolios — to balance their asset mix and preserve their wealth in an increasingly uncertain world.

This begs the question, if central banks are buying gold as a safe haven, an inflation hedge, to diversify their reserves away from the dollar, and to fortify their holdings against an economic downturn — why aren’t you?

This article was brought to you by Orion Metal Exchange, a top-rated precious metals dealer with “live” product pricing, full price transparency and best-in-class customer service. A precious metals expert is standing by at: 1-800-559-0088