There’s No Place Like Gold – The Unprecedented Factors that are Driving the Yellow Metal

Gold is shaping up to be one of the best investments of 2024. At the beginning of the year, Saxo Bank dubbed 2024, “The Year of The Metals,” and it has certainly lived up to that billing.

“Following a surprisingly robust performance in 2023, we see further price gains in 2024. Gains driven by a trifecta from momentum-chasing hedge funds, central banks continuing to buy bullion at a record pace, and renewed demand from ETF investors, such as asset managers … With the US Federal Reserve pivoting towards rate cuts, we see the current number of expected rate cuts being justified by a soft landing, while a hard landing or recession would trigger an even bigger need for rate cuts.”

These price drivers proved to be dead on as gold prices, year-to-date, are up over 25% having hit successive record highs — while silver prices are up over 30%. The outlook for gold is particularly bullish as experts point to the alignment of key price triggers that will likely drive gold higher into 2025.

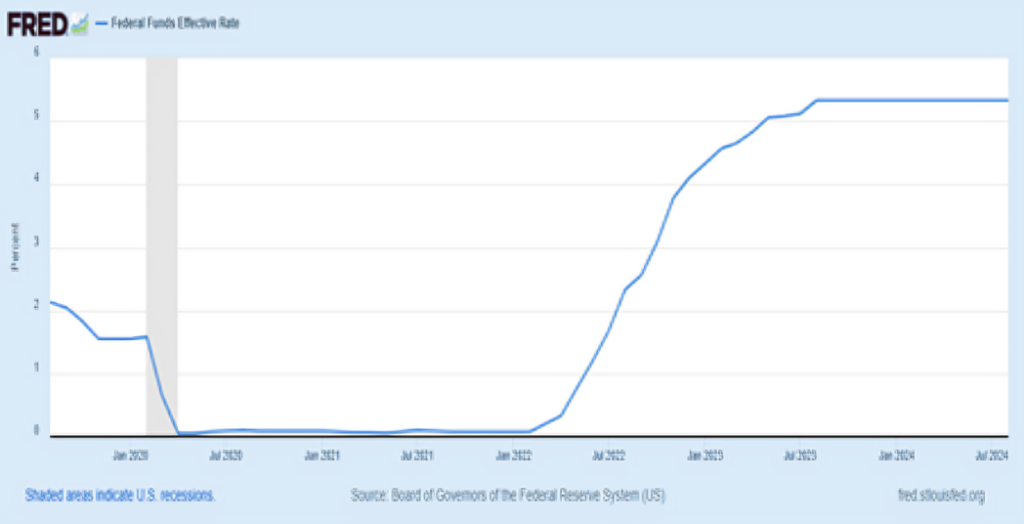

Looming Rate Cuts

The Fed is now poised to cut interest rates for the first time in four years. Back in the dark days of 2020 as Covid was shutting down the economy, the effective federal funds rate was as low as 0.05% (April of 2020) before the Federal Reserve embarked on the fastest tightening cycle in forty years. As the Fed grappled with soaring, pandemic-fueled inflation, they raised rates eleven times between March 2022 and July of 2023. The Federal Funds Rate currently sits at 5.33%.

Gold has traditionally had an inverse relationship with interest rates — meaning when rates are high, gold tends to move lower in price because it offers no yield. But when rates are low, other assets are less attractive subsequently driving more investors to gold, increasing demand, and driving up prices.

But gold is also considered to be an inflation hedge and a crisis asset and since the first cases of Covid were confirmed the United States in January of 2020, gold prices have increased almost 68%. Now the Fed’s planned rate cuts have bullion prices climbing once again and the prospect of successive interest rate cuts is keeping gold at record levels.

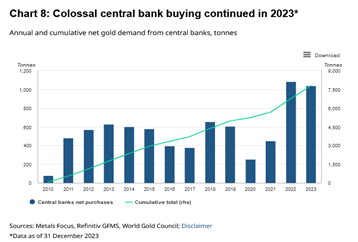

Central Bank Buying

Central Bank gold purchases have been a key driver of gold demand for well over a decade but according to the World Gold Council, 2022 and 2023 shattered all known records.

“Two successive years of over 1,000t of buying is testament to the recent strength in central bank demand for gold. Central banks have been consistent net buyers on an annual basis since 2010, accumulating over 7,800t in that time, of which more than a quarter was bought in the last two years.

Findings from our 2022 and 2023 Central Bank Gold Survey show that gold’s performance during times of crisis and its role as a long-term store of value are key reasons for central banks to hold gold.”

Central bank gold buying set another record through the first half of 2024, driven by hefty purchases by China, Turkey, and India. Central banks buy gold for the same reasons that investors do — as a hedge against inflation, as a portfolio diversifier, and to offset the risk of a weakening U.S. dollar.

According to the WGC’s Central Bank Gold Reserves Survey, 81% of respondents indicated that they expect to increase their gold holdings over the next 12 months, the highest ever recorded since the survey’s inception.

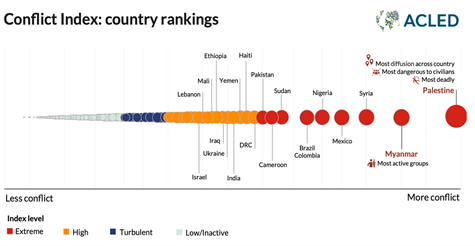

Geopolitical Tensions

Gold also thrives amid global chaos and a world embroiled in armed conflicts in Ukraine and Gaza, territorial disputes in the South China Sea, and an imminent confrontation over Taiwan, has been a positive trigger for gold prices.

According to the Jerusalem Post:

“Geopolitical events have also played a role in pushing gold prices to new heights. Ongoing conflicts, particularly in Eastern Europe, rising tension in the Middle East, and economic sanctions against major global players have led to increased demand for safe-haven assets. Investors have turned to gold when there’s uncertainty on the international stage, as it tends to hold its value better than other assets in times of crisis.”

According to ACLED (Armed Conflict Location and Event Data Project), 1 in 7 people worldwide are estimated to have been exposed to conflict thus far in 2024, 50 countries rank in the index categories for “extreme,” “high,” or “turbulent” levels of conflict, and incidents of political violence have increased 15% in the last 12 months.

The top global risks for 2025 that could push gold prices to all-new price highs include the outcome and implications of the U.S. 2024 election, the state of US-China relations, the status of the Israel-Hamas War and the Russia-Ukraine War, and the major elections set to take place in Japan, Germany, Canada, and Italy in 2025.

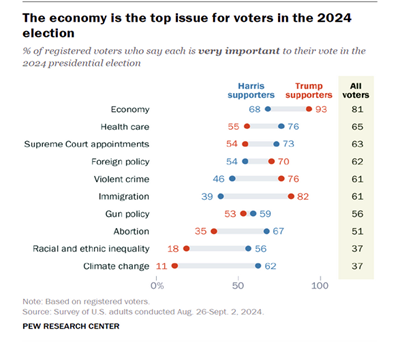

The U.S. Election of 2024

The upcoming 2024 U.S. presidential election is considered by many to be the most important in recent history. It is not only pivotal in terms of economic policy, taxation, border security and foreign policy — it has far-reaching ramifications on more polarizing issues like abortion, racial equality, and climate change.

According to a recent survey by Pew Research, the economy remains the top issue but a majority of voters cite other issues as important to their vote including healthcare, supreme court appointments, and violent crime.

The 2024 presidential election is historic on other counts. It is the first time in almost 50 years that a presidential candidate will not have the name Biden, Bush, or Clinton. It is the first time an impeached president (Trump) has been nominated for another term. It is the first time a woman of color (Harris) is leading a major party’s presidential ticket. And it is the first-time in American history that there have been two assassination attempts on a single presidential candidate.

Clearly America’s discord has reached a boiling point and U.S. politics have become at once dangerous and dysfunctional as outlined by the National Post:

“Dread is on the rise across the United States as the nation slides toward its next tempestuous election. The mood is dark … America is now what Abraham Lincoln called ‘a house divided.’ The worldviews of urban and rural voters, of those with traditional social values versus those more progressive and those who are more globalist in their outlook versus those more populist, now have vanishingly little in common.”

This deep polarization will translate to less compromise and more stalemates no matter who gets elected. Gold thrives in moments of political division because policy uncertainty often leads to volatility, economic instability, and systemic risk – all conditions ripe for gold’s safe haven attributes.

Perhaps this is why renowned multinational financial service companies and investment banks like Goldman Sachs, Morgan Stanley, and Bank of America are calling for gold prices to continue to rise at a brisk pace into 2025.

This article was brought to you by Orion Metal Exchange, a top-rated precious metals dealer with “live” product pricing, full price transparency and best-in-class customer service. A precious metals expert is standing by at: 1-800-559-0088